What Is A Hard Money Loan?

WHAT IS A HARD MONEY LOAN?

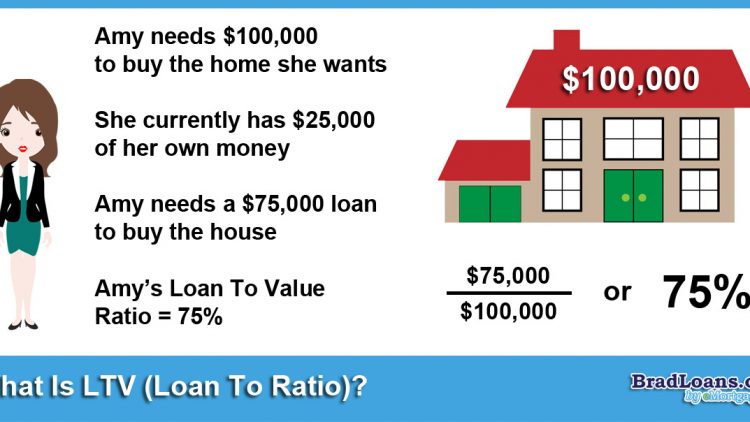

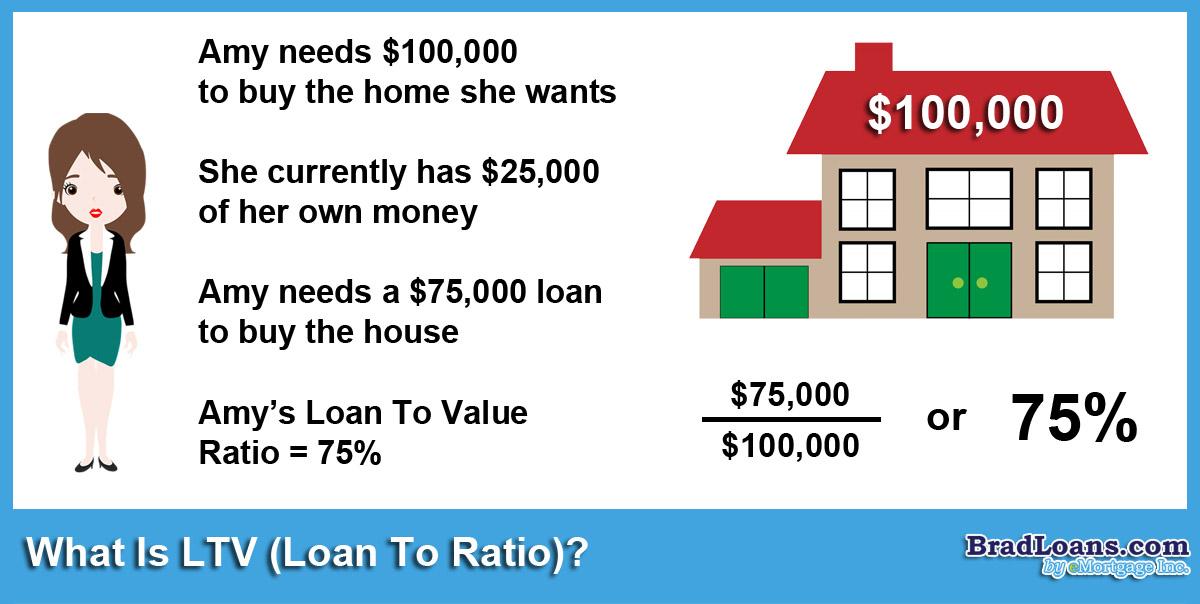

The definition of hard money loan is: A last resort loan or short-term loan to close a bridge or gap in your finances. A hard money loan is not based on credit but it backed by the overall value of the property. Due to the property being used as the protection against default from the borrower, these type of loans usually have a low loan-to-value ratio also known as (LTV) typically lower than other traditional loans.

According to Investopedia, “A hard money loan is a type of loan that is secured by real property. Hard money loans are considered loans of “last resort” or short-term bridge loans. These loans are primarily used in real estate transactions, with the lender generally being individuals or companies and not banks.”

- Hard money loans are mainly used for real estate transactions and are money from a company or an individual and not a financial institute.

- A hard money loan, typically taken out for a brief period of time, is a way to raise money fast, but at higher costs and a lower loan to value (LTV) ratio.

- Since hard money loans aren’t commonly executed, the funding deadline is extremely reduced.

- The conditions of hard money loans may frequently be negotiated between the lender and the borrower. These types of loans usually use property as the collateral.

- Repayment could lead to default but nevertheless end up in a profitable business deal for the lender.

Brad Loans Explains “Hard Money Loans”

A hard money loan will usually carry higher interest rates than subprime loans or traditional loans. Traditional lenders don’t usually make hard money loans, hard money lenders are usually private investors that see potential in this risky market. Hard Money loans are commonly used in quick flip, short term financial needs or by loan borrowers with bad credit but have equity in the property they own and wish to avoid foreclosure.

How Does a Hard Money Loan Work?

Hard money loans have conditions that are mainly based on the value of the property that is used as collateral, and not on the credit worthiness of the borrower. Because traditional lenders, like banks, don’t execute hard money loans; hard money lenders are usually private individuals or companies that see worth in these types of possibly risky endeavor.

Hard money loans might be wanted by property flippers that plan to renovate and then resell the property that’s used as collateral for the financing—usually within a year, if not sooner. The higher costs of hard money loans are offset by the fact that the borrower plans to pay the loan off somewhat fast—some hard money loans are for 1 to 3 years—and by many of the other benefits, they provide.

Hard money lending may be considered as an investment. There are a lot of individuals who’ve used this as a business format and proactively practice it.

Unique Considerations for Hard Money Loans

The costs of a hard money loans to the borrower is usually higher in comparison to the financing available using government lending programs or banks, considering the higher risk that the lender is undertaking by offering the financing. Nevertheless, the increased expense is a tradeoff for faster access to funding, a less strict approval process, and possibly flexible in the repayment schedule.

Hard money loans can be used in short term financing, in turnaround circumstances and by borrowers that have bad credit but considerable equity in their property. Because they can be issued fast, hard money loans may be used to avoid foreclosure.

The Pros and Cons of Hard Money Loans

Hard money loans have their pros and cons. Keep reading to learn more about the pros and cons of hard money loans.

Pros of Hard Money Loans

One advantage is that the approval process for a hard money loan is usually much faster than applying for a mortgage or other conventional loans using a bank. The private investors that back hard money loans can make decisions faster since they usually do not do credit checks or review a borrower’s credit history—the steps lenders typically take to investigate a potential applicant’s capability to make their loan payments.

These investors are not as concerned about getting repayment because there might be an even greater worth and the possibility for them to resell the property themselves, should the borrower default.

An additional advantage is that because hard money lenders don’t use a conventional, customary, underwriting method, but assess each loan on a case by case basis, applicants can usually negotiate modifications regarding the repayment schedule for the loan. Borrowers may aim for more chances to pay back the loan during the timeframe available to them.

Cons of Hard Money Loans

Because the property on it own is used as the only safeguard against default, hard money loans typically have lower loan to value (LTV) ratios than conventional loans do: around 50 percent to 70 percent vs. 80 percent for standard mortgages (though it may increase if the borrower is a seasoned flipper).

Additionally, their interest rates are prone to be higher. For hard money loans, the rates may be even higher than those of high-risk loans. As of 2019, the rates of hard money loans were ranging from 7.5 percent to 15 percent, subject to the duration of the loan. Comparatively, the prime interest rate was 5.25 percent.

One other disadvantage is that hard money loan lenders may choose to not offer financing for an owner occupied residence considering regulatory monitoring and compliance by laws.

Hard Money Lenders in Phoenix, AZ

When you are searching for hard money loans near me in Phoenix, Scottsdale, Glendale, Tempe, Mesa, Chandler, or Gilbert, Arizona; Brad Loans is Arizona’s most trusted direct hard money lender! We specialize in hard money loans for Fix and Flip, refinancing mortgages with bad credit, business loans secured by real estate, real estate purchases, short sales, and other endeavors with quick turnaround in the Phoenix Valley.

BradLoans.com is the most trusted direct hard money lender and private money lender in Arizona! We are the best hard money lender in Arizona with the ability to fund commercial & residential hard money loans many times within a couple days or less. Our lending rates and fees are reasonable compared to other Arizona hard money brokers or mortgage brokers in Arizona.

Sign Up For Our E-Newsletter!

Need a Private Money Loan Anywhere in Arizona?

Brad Loans offers private money loans in many areas of Arizona including Phoenix, Mesa, Tempe, Chandler, Gilbert, Cave Creek, and Flagstaff.

The hardest part of accomplishing fix and flips is being able to locate the properties. Once the properties are found, all that is needed is to work at getting them for as little as possible. Remember, they have to be cheap enough that they are going to be worth flipping.

The hardest part of accomplishing fix and flips is being able to locate the properties. Once the properties are found, all that is needed is to work at getting them for as little as possible. Remember, they have to be cheap enough that they are going to be worth flipping. Using a Hard Money Loan to purchase property means there doesn’t have to be much money put down. The loan is based off of what the value of the property will be after it is fixed and gets flipped.

Using a Hard Money Loan to purchase property means there doesn’t have to be much money put down. The loan is based off of what the value of the property will be after it is fixed and gets flipped. Private Money

Private Money