What Is LTV – Loan To Value Ratio?

WHAT IS LTV – LOAN TO VALUE RATIO?

If you’re searching for “what is ltv?“, “what is ltv ratio“, “what does ltv mean“, or “what is a good loan to value ratio” this post will help! LTV ratio (loan-to-value ratio) is a ratio used to determine lending risk assessments reviewed by financial institutions and various types of lenders prior to approving mortgage loans. Usually, if an assessment has high LTV ratios, they are considered to be a high risk, thus if the mortgage loan gets approved it will often be at a much higher cost to the borrower. In addition, loans that have higher LTV ratios could require mortgage insurance to be purchased by the borrower to offset the lenders high risk.

BREAKING DOWN ‘Loan-To-Value Ratio – LTV Ratio’

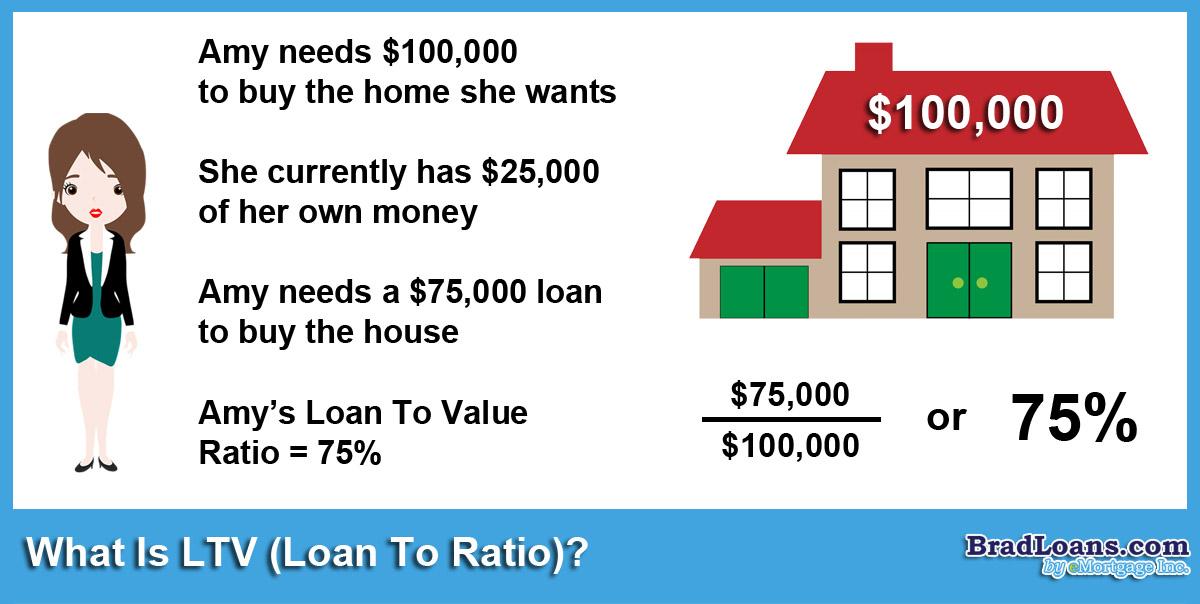

To calculate the LTV ratio, the mortgage lien amount is divided by the properties appraisal value, which is provided as a percentage. For instance, when a $92,500 mortgage is taken out by the borrower for purchasing a property with an appraised value of $100,000, the LTV ratio calculations would be 92.5%, or 92,500 out of 100,000.

Therefore, LTV ratios are an important part of mortgage underwriting, whether or not for purpose of refinancing existing mortgages into new loans, buying a residential property, or simply borrowing against a property’s accumulated equity.

Every lender assesses loan-to-value ratios to decide the exposed risk levels that they will have if approving a mortgage, which is calculated as delta between the total borrowed amount and property’s appraisal value. When a borrower requests a loan near or at appraisal values, the LTV ratio become higher, which is perceived by lenders as a larger risk of the borrow defaulting on a loan due to having little or no equity within the property. Therefore, in the event of a foreclosure occurring, lenders could have challenges selling the property for the sufficient amount of covering the mortgage balance while making a profit from the sell.

High LTV Ratio Implications

Although financial institutions use more than the LTV ratio for deciding on securing home equity and mortgage loans, or line of credit, it has a major role with the overall expense to the borrower. Most lenders provide home equity and mortgage applicants with interest’s rates as low as possible when the LTV ratio score is 80% or less. However, higher LTV ratios do not exclude a borrower from getting approval for the mortgage loan, but it increases the total costs associated with the loan the higher the LTV ratio is. For example, if a borrower has a 95% LTV ratio, they could be approved for the mortgage loan. However, the interest rate offered could be up to one percent point higher compared to a borrower with a 75% LTV ratio. Additionally, with higher interest rates, lenders can add on the requirement of borrowers purchasing mortgage insurance with higher LTV ratios. Mortgage insurance can greatly increase the monthly mortgage payments for a borrower, and the mortgage insurance coverage can be required until the LTV ratio is under 80%.

What Is A Good Loan To Value Ratio?

What LTV ratio is good and is able to assist with getting approved for a loan?

This will depend on the type of loan and lender’s preference. You will commonly have a higher approval chance by investing more equity, or having a lower LTV ratio.

The magical number for home loans is 80%. If you try to get a loan over 80% of the homes appraised value, you typically require a PMI (private mortgage insurance) for protecting the lender against high risk. This is an additional expense, but it can often be canceled once the borrower lowers the LTV ratio under 80%.

Additionally, 97% is another significant number. There are lenders that will allow borrowers to purchase with a minimum of 3% down, however, you will be required to have mortgage insurance coverage and could be required for the lifespan of the loan. FHA loans will require 3.5% down.

When it comes to an auto loan, the loan-to-value ratio commonly gets higher, but limits or maximums can be set by lenders, while changing rates of the borrower based on how high the LTV ratios are. There are situations where a borrower may be able to get approved with an LTV ratio over 100%.

Brad Loans Offers Up To 100% LTV With Cross Collateral

Brad Loans offers 100% FINANCING if borrower has an another property that is free and clear or the property that has positive equity (it’s worth more than is still owed), it can be pledged as additional collateral (aka a Cross Collateralized Loan). Learn more about 100% LTV hard money loans here.

Sign Up For Our E-Newsletter!

Need a Private Money Loan Anywhere in Arizona?

Brad Loans offers private money loans in many areas of Arizona including Phoenix, Mesa, Tempe, Chandler, Gilbert, Cave Creek, and Flagstaff.